Many are saying that we have wallet wars in our hands. Is it really war of wallets? It’s actually all about ecosystems. In this post we look through few main wallet approaches and how their ecosystem models work.

Note: this blogpost was published earlier in Medium by Antti Kettunen.

Digital identity and personal data management are great enablers for digitalization of business and society. As we progress further, we find that traditional centralized identity management approaches are becoming bottlenecks for providing seamless and personalized service. Furthermore, soon we will be no more bound to browsers and mobile apps, as digital services are becoming ubiquitous, covering also physical touchpoints, cars, apartments and even smart cities. With the increased need of highly secure & usable digital trust mechanisms, new digital identity management approaches are needed. New approaches that would provide better overall usability and interoperability offline and online, with potentially better access and control for the identity data. Our identities cannot be anymore bound to individual siloed services, but we need digital identity approaches that work across all kinds of systems.

For the past years, interest and development on mobile identity wallets have grown significantly. Identity wallets run in a smart phone seem to be a viable solution for carrying and using your digital identity across services. Among other things they are user-centric, provide authentication and credential exchange solutions across services, and include proven capabilities to cryptographically protect sensitive data. Identity wallets can host many other kinds of features for identity management such as more advanced data exchange patterns, permissioning, personal data storage, personal data dashboards and links to payment systems. Additionally they may also have cloud backend services (sometimes called cloud agents) that enable offline queueing and routing, backup and secure data storage services, and even customer service support. Overall, digital identity wallets seem to be a good fit for what is needed for adoption of user-centric digital identity management, and many are counting on it.

Many professionals have raised the fact (see here, here and here) that we are witnessing a war of (digital identity) wallets, which bears resemblance to the infamous browser wars. The outcome of this war may fundamentally impact what is the future landscape for all digital services and what is the home for our digital identity. Who is actually involved in this war and how different outcomes could affect our future?

The three wallet scenarios

Although there is much talk about wallets, there is very little discussion and awareness about the ecosystems and outcomes of each wallet scenario. With this writing we want to initiate discussion, because we think the future of digital identity management for many years is defined by the outcome of the battle between these three approaches.

We’ve identified at least three different kinds of identity wallets coming to the market:

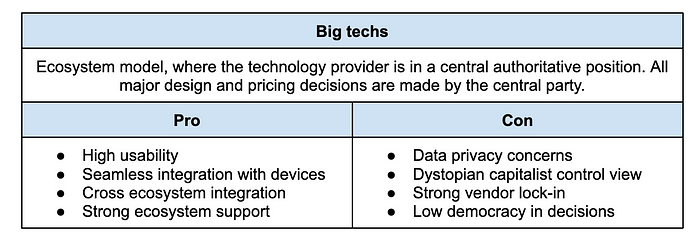

- The bigtech mobile platform giants are extending their platform capabilities with identity wallets.

- The public sector, like the European Union and its member states are revising their digital identity approach with legislation and national wallet services.

- Independent wallet providers that provide a market-driven and open approach, including both free and commercial services.

Although from the outside, they seem very similar and may even share a similar vision, these three wallet scenarios are playing with very different assets and resources and aim for very different ecosystem mechanisms. The reality of the outcomes become apparent once each wallet is dissected from the ecosystem perspective.

Wallet approach #1: The Big tech wallets — case Apple

The big techs like Apple and Google are the natural de facto players with their wallet ecosystem. And Apple seems to be leading the way of identity wallets with their Apple wallet. Apple wallet is a familiar service for many since you have been able to store your plane and concert tickets to the wallet for years already. Gradually Apple has been increasing the features of the wallet and today you can also use the Apple Wallet for identification, presentation of driver’s licenses, and many others.

Apple Pay as the gateway drug

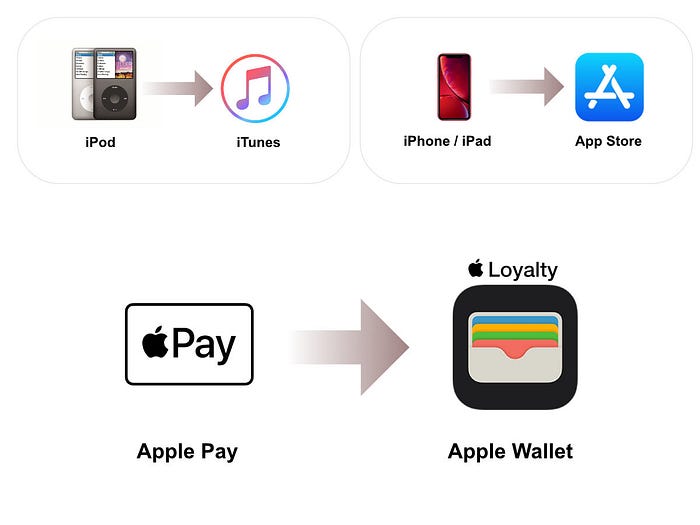

Apple has always been the master of ecosystems. They realized early on that the key to make long-term repeatable business is by locking everyone into their ecosystem of solutions. Apple’s strategy has long been the control of a full ecosystem stack from hardware, operating system, applications, marketplace and relying party ecosystem. This was evident when iTunes was the ecosystem for music on the iPod, and when the App store enhanced your iPhone and iPad.

“Apple is developing the Apple Wallet as a loyalty ecosystem”

Similar to the music and app experience, Apple Pay is going to be the gateway to the Apple Wallet ecosystem. One would think it’s the other way around, but think from the business perspective: The Apple wallet becomes very efficient when it is the host for your loyalty identification and used together with Apple pay. Bundled with its superior simplicity and usability it becomes very attractive to consumers and businesses alike.

Let’s be clear: Apple is developing the Apple Wallet as a loyalty ecosystem, and its goal is to provide a master loyalty app experience through wallet including points, pay-with-points, promotions, customer service messaging, geofencing and more. And this sounds great to many customers and probably to many merchants too! No need for separate apps, which are cumbersome to take in use and develop.

Apple loyalty program anyone?

With this approach Apple becomes a loyalty intermediary with a lock-in to loyalty transactions and communication. As an intermediary, Apple can monetize these transactions, turn the wallet into media and further increase its ecosystem lock-in. Just think how the intermediaries like Google and Meta take the lion share in the digital marketing ecosystem, and publishers and content providers ultimately get only 30–40% share of what merchants pay for the income. And think about how Apple is already selling ads to the App Store, so why would they not do the same for Wallet?

Many of us are already hard locked to the Apple ecosystem, but with the wallet’s loyalty features, this may be boosted yet to a totally new level crossing all kinds of loyalty transactions.

Some say that this is not so bad since Apple is a data good guy, right? They respect and protect your privacy, so Apple is probably a good option for this kind of platform. If Apple can (and will) make this market, then Google just needs to follow. Markets need the same features for Android platform and merchants too. For users and merchants having symmetrical value proposals from both mobile platforms makes everything more simple, so Google just needs to follow.

Wallet approach #2: Public sector — Europe has learnt a lesson

Public sector organisations and governments have perhaps been the earliest proponents of digital wallets. As public sectors everywhere deal with a myriad of digital identity reliant services and identification challenges, it’s only natural that they are interested in progressing the domain. Although some governments have been developing their Digital Identity strategy and framework systematically for a decade (see Canada’s DIACC), some nations are much faster and direct in their approach, like Bhutan, who just released their new digital identity program, based on digital wallets & self-sovereign identity.

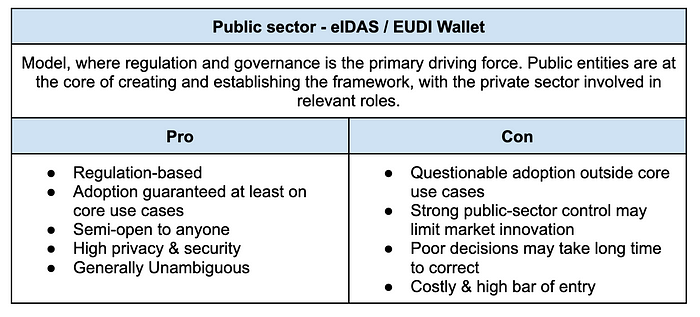

The European Union and its local governments have realized the power of wallets too. The first version of eIDAS (electronic IDentification, Authentication and trust Services) was established in 2014, but it failed to deliver its promise. It was based on traditional federated national eIDAS nodes, and it never scaled and became interesting enough due to its low business incentives, and public-sector only focus. The new revised initiative eIDAS 2.0 with its EU Digital Identity wallets and revised regulation will not make the same mistakes. The EUDI wallets are coming, and they will play a significant role in the authentication and credential exchange in the future.

EUDI wallets will try to solve multiple key use cases that touch upon the lives of every EU citizen. Such use cases include mobile driver’s license, pan-European identification and authentication, personal identity attribute exchange and payment verification, to name some.

EUDI ecosystem — high bar & strong privacy

EUDI wallets will form an ecosystem for identification and credential exchange in Europe. It allows the private sector businesses to create EUDI compatible wallets, but it’s still the member states that decide which wallets they endorse and thus allow to be official EUDI wallets. EUDI wallets & services implement a common architecture designed in the Architecture Reference Framework. Strict control over the architecture and requirements mean also high focus on privacy and trust, which have been long-term goals for the EU. The implementing services (attribute issuers, wallets and relying party services) are provided by Trust Service Providers, who will need to go through extensive auditing to be accepted.

Although the EUDI framework also mandates use of wallets in certain private sector domains, it is not clear how broadly we’re going to see commercial wallets pursuing opportunities in this ecosystem. The EUDI business model is likely going to be a challenge. The requirements for complying with EUDI are not going to be small for service providers, as cost for compliance can be calculated in hundreds of thousands of Euros annually, with setup costs to become a Trust Service Provider is estimated around 800K€ (source: eIDAS impact assessment, part 1). eIDAS legislation also requires that the wallets are made free of charge, with no decided business models on the market that would make the wallet ecosystem financially attractive and sustainable.

In the US, Apple has already started supporting driver’s license credentials in some states. Becoming EUDI compatible might be an interesting opportunity for Apple since the cost to comply is not an issue for Apple, and not asking a fee for customers is just aligned with Apple goals for maximum reach and engagement for their wallet use. Public use cases would nicely complement Apple’s value proposal.

Becoming an EUDI wallet might be a good complementary use case also for independent wallets as well, but as the current ecosystem model may take years to become sustainable, will it grow fast enough? The risk in the EUDI wallet ecosystem is that it may become dominated by bigtech wallets. Is Europe really ok, if Apple and Google wallets become the de facto EUDI wallets? Or does Europe actually need a market full of commercial options for digital wallets?

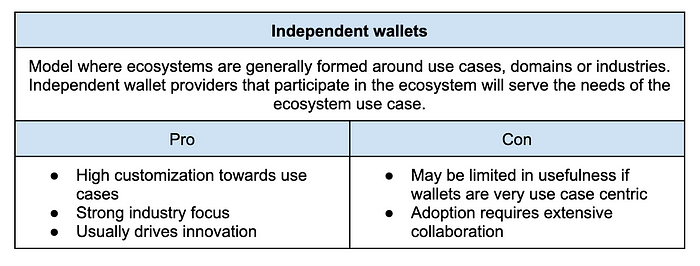

Wallet approach #3: Independent wallet providers — the outsiders

There is a third branch of wallets, which we call independent wallets. This is a heterogenous group of organizations that have been building wallet services and standards, and offer their services individually from earlier frameworks. Some of these wallets rely and focus on open standards development and are part of the communities such as Trust over IP, Hyperledger Foundation, MyData Global or Open Wallet Foundation. Some are strong on collaboration, while others might have a more independent agenda and business ideas. Some have already marginal business cases either in focused consumer domain or in some special user groups such as business to employee, in replacing traditional employee identity and access management use cases (eIAM). Among independent wallet providers there is generally awareness and interest towards EUDI, but no clear sight on how to make business out of it.

These wallets are an interesting and buzzing domain but without currently clear business alignment. While individual businesses might have a business case, the community as a whole does not converge and focus towards developing a joint ecosystem approach. They are clearly competitors and out of the Apple and Google ecosystems. Some of them may play a part in the EUDI or other larger ecosystems. Other ecosystems like for example Common European Dataspaces or Gaia-X are still too immature to acknowledge how they could deliver clear business cases for independent wallets, even though there is pending interest towards them. These wallets are acknowledged as great tools, and are used in individual projects, however, they have not yet managed to come together to form anything substantial or with an impact. So this begs the question: what’s the real market for them?

“…once the system clicks and reaches some minor level of critical mass, then it just starts to scale and grow in reach and impact.”

Why is this important? If markets do not ask for them, then why do we need independent wallets? Here we need the perspective on ecosystem evolution and incubation. Ecosystem foundations are built from small use cases and structures, and once the system clicks and reaches some minor level of critical mass, then it just starts to scale and grow in reach and impact.

Our strong statement is that independent wallets would be a very good option for many private and commercial ecosystems such as smart cities, mobility, finance, retail & loyalty systems. Instead of relying on Apple and Google, digitally savvy organizations should start to develop their own ecosystem strategy, and find their ecosystems that enhance and grow their business.

Instead of Apple and Google, independent wallets would not take such a strong (and costly) role in the ecosystem, they would allow more innovation through competition and evolving use cases, and there would be options for individuals and businesses which would create resilience and freedom. Societally, sustainable markets and ecosystems for independent wallets would be very important for achieving data sovereignty.

Preparing for the (wallet) ecosystem wars

War of wallets is not a feature war between wallet apps. It is a war between ecosystems, and the winner is the one providing the highest perceived value for the end-users. However the best scenario is not where one wins and others wither away. Instead we should focus on finding the combination of ecosystem features that will best support each other. Our digital world is not, should not, and hopefully never will be based on only one ecosystem. As much as our business world is composed of diverse industries, cultures and disciplines that intersect to form a Medici innovation effect, so too our digital identity ecosystems should find innovation in its intersections.

For independent wallets and those reliant on making business through ecosystems, this means building and strengthening industrial collaboration, developing common business models, and advancing practical use cases. Open ecosystems can generate best value for society and most potential for innovation. But in the early phases of open ecosystem development it is hard to invest in development, since the actors are not in a good position to “own” the ecosystem or gain sustainable competitive advantage. For this reason open ecosystems require novel ecosystem incubation approaches.

As bringing together multiple players in the industry is a daunting task, in the next collaborative blog post we will dig deeper into the ecosystem creation process and what kind of resources we can employ when bootstrapping ecosystems and finding innovation in them.

This blog post has been co-written by Antti Kettunen in collaboration with Dr. Kai Kuikkaniemi. Kai wears two hats in the data ecosystems and digitalization space: Broader data ecosystems expert role while working in the MyData Global as senior advisor in the Data Spaces Support Center; and practical hands-on EA working for a big retailer in loyalty, marketing and payments.

This post was published earlier in Medium by Antti Kettunen.